Amid a dwindling Social Security retirement trust and increased national life expectancy, many Americans are uncertain about their financial future.

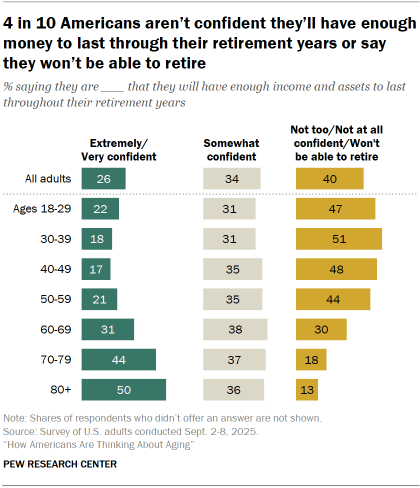

Four-in-ten U.S. adults say they aren’t confident they’ll have enough income and assets to last throughout their retirement years or say they won’t be able to retire at all. Only about a quarter (26%) are extremely or very confident.

Older adults are the most confident about their finances in retirement. Still, fewer than half of those in their 60s and 70s are highly confident, compared with 50% of people in their 80s and older.

These findings are based on a survey of 8,750 U.S. adults conducted Sept. 2-8, 2025, aimed at understanding how Americans are thinking about and experiencing aging. Read key findings from the full study.

How uncertainty about finances differs by groups

The share of U.S. adults who are uncertain – that is, they aren’t too confident or aren’t confident at all that they’ll have enough income and assets to last throughout their retirement years or say they won’t be able to retire – varies by demographic group.

- Income: 57% of adults with lower incomes express uncertainty about their retirement finances. This compares with 38% of adults with middle incomes and 15% of those with upper incomes.

- Race and ethnicity: Half of Hispanic adults are uncertain about this, compared with 41% of Black adults, 37% of White adults and 30% of Asian adults.

- Gender: Women are more uncertain than men (42% vs. 36%). Notably, men ages 75 and older are the most confident about their retirement finances. About six-in-ten (61%) in this group are highly confident, compared with 40% or fewer among men and women in younger age groups and women ages 75 and older.

Financial worries as younger adults look ahead – and older adults look back

We asked adults under 65 who say they’re worried when they think about what life will be like in their 70s and beyond to tell us, in their own words, what they’re worried about.

While health concerns topped the list, financial worries were the second-most common response. Three-in-ten cited concerns about not having enough money in retirement, the availability of Social Security or the increasing cost of living.

Similarly, when we asked adults ages 65 and older what advice they have for younger people to prepare them for getting older, 37% mentioned habits like saving money, investing and living frugally. Only health-related advice was more common, offered by 49% of older adults.

On both questions, the third-most common theme trailed finances by more than 10 percentage points.

About a quarter of older adults (24%) gave general advice, such as “Live life to the fullest,” “Be true to yourself” and “Be kind to others.”

And among adults under 65 who feel worried when they think about life in their later years, 16% said they worried about things related to family relationships, such as loneliness, losing loved ones or becoming a burden.

Read more about advice adults ages 65 and older would give to younger adults.